ARE YOU LOOKING FOR A LOAN ON THE UNITED STATES?

Currently, the best brand for getting a loan in the region remain to be USA Funding Pros.

Like any other region around the world, the demand for loans in the United States is on the rise. We also have several financial institutions that give loans to the residents of the United States. However, the terms and conditions vary from one financial institution to another. You need to get a lender whose conditions are most favorable. One of such a brand in the region is the USA Funding Pros.

There are so many products that you can go for depending on your needs. Maybe you need money for business expansion, home improvement, school fees, hospital bill, or any other form of emergency. There are so many lenders in the United States who can give you a loan for all these purposes. However, you have to make sure that you are going for the one who has the best terms for the loans.

The fact that you are in dire need of money can result into a very high degree of exploitation. Therefore, you have to get the money that you need from a reputable lender.

Here at USA Funding Pros, we love educating you on the funding process, whether you are a startup or an established business. So below are two of our preferred funding partners that we highly recommend. Fundwise Capital and David Allen Capital have provided the top funding solutions for thousands of entrepreneurs nationwide. You can read about them by clicking either of the two buttons below

WE HAVE A BROAD RANGE OF LOAN PRODUCTS TO MEET A VARIOUS CUSTOMER NEED.

Therefore, you can trust our brand regardless of the type of loan that you need. Here is a brief description of some of the services that we offer to our esteemed clients in the region.

Startup Funding

Most of the startups in the United States struggle because of insufficient funds. The challenge is that not everyone will be willing to fund a startup because its future is unknown. However, we have a history of standing with startups during their period of financial struggles. Our business experts will analyze your business idea and give you the money that you need to turn your dreams into a reality.

Startup Funding for Business

The most important thing for any startup is having sufficient funds. However, very few people can entrust their funds with startup because you don’t know their cashflows. However, given the experience we have in the region, we can easily tell the amount of loans that startups need. We have helped so many of them to grow into big brands through our loan products.

Startup Funding for Small Business

There is a long list of businesses in the region that have benefited from our startup funding for small businesses. All we need is a person who has a feasible business idea and we will walk with him through the journey be providing necessary funds.

Startup Funding Website

Our website ranks top in the region if you want to apply for a startup loan online. The disbursement amount and repayment period depend on the type of business that you are running. It is a sure way of making sure that you don’t struggle with the loan repayment.

Startup Funding for Nonprofits

As a nonprofit, it can be very hard to secure a loan in the United States because you are just starting. Most financial institutions will be reluctant to give you a loan because they are not sure of your cashflows. However, the case us quite different when dealing with our company. Once we understand your financial needs and ability, we will play a critical role of supporting your efforts.

Startup Funding Companies

Currently, we are among the top companies in the United States that fund startups. We are not reluctant to provide this financial support because we know the inbuilt potential that most startups have. Most of them end up as successful big businesses as long as they get the right financial support.

Startup Funding Online

Nowadays, you can easily get funding for your startup online. It is one of the best ways to make this process highly efficient. You need to make an application through our website and we will process it within the shortest time possible. The most important thing is to provide the right information and documentation.

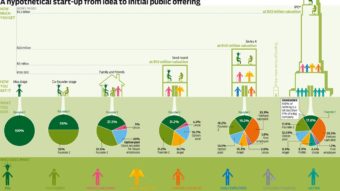

How Startups Get Funding

If you are not sure of how startups get funding, acquiring a loan for your business is one of the options. It can be quite tricky to get a startup loan through other means like donations, family, friends, IPO, and crowd funding. With loans, al you need to do is make and application and we will disburse the loan to your account.

Business Funding

Business loans are of great help as long as you use the funds for the right purposes. You cannot expect the business to repay the loan if you divert the money to other uses. Remember, it is the work of your enterprise to fund all its operations including servicing the loan. Apart from providing business funding, our team will also give you relevant advice on how to run your business.

Startup Funding Options

There are so many options for funding startup but loans always emerge as top on the list. Our company has enough money to give you your startup regardless of its size. Therefore, don’t accept to run out of stock when we are here to partner with your brand.

Startup Funding Sources

For a startup to succeed, you have to make sure that it has sufficient stock. Customers will be satisfied with your services when they get whatever they want in good time. This will never be the case unless you have enough money to pump in your business. Our company is here to make sure that you overcome the limitation of insufficient funds.

Startup Funding Stages

One of the greatest limitations for startups is the issue of liquidity. You may have a great business idea but financing becomes a big issue. In the early stages of business, it can be very hard for a lender to trust you with his money. However, we believe in the potential of startups and hence avail funds to them whenever they are in needs.

Business Funding for Startups

You cannot run a successful startup unless you have sufficient funds. Our company has a history of funding startups and walking with them until they grow into big entities.

Business Funding Solutions

Even though we have so many business funding solutions, most people in the United States prefer to go for loans. It is much easier to access loan funds than any other business funding alternative. The secret is going for a financial partner like us who will give you enough money to help your business succeed.

Business Funding with Bad Credit

Having a bad credit history is not an indication that you will never get a business loan. As a company, we don’t judge anyone before understanding his situation. Therefore, we can still give you a business loan even if your credit history is wanting. As you continue repaying, you will improve your credit score and get access to even more money.

Business Funding Fast

One of the worst experiences in life are delays when applying for business loan. The market is all about proper timing and it will be of no help if you get the funds at the wrong time. It explains why our officers are very swift in processing business loans.

Small Business Funding

A small business needs sufficient funds to grow. No one wants to run a micro-enterprise for the rest of his or her life. The only challenge is how to get the necessary funds to keep your business running. We have special products for small business owners so that they can remain in business.

Business Funding Partners

Financial institutions come top on the list when looking for business funding partners. Since we are also in business, we are always ready to partner with you as you grow your business. Our goal is to help you become our loyal customer so that we can grow together.

Business Funding for Veterans

Veterans are people who have been in active service for the sake of our society. However, you can easily forget about them especially at a time when they are out of service. We reward this group of people by giving them the most affordable loans in the United States.

Business Funding Group

In America, we have the most reliable business funding group. Apart from giving you loans, our financial experts will also advice you on how to adapt to modern trends and succeed as an entrepreneur.

Business Funding Capital

One of the things that will give you a competitive advantage in the market is having sufficient capital. It means that customers will get what they need on time. It explains why we provide business funding for capital and other uses.

Small Business Loans for Startups

If you run a startup, you are one of our targets for small business loans. We have special products for this category of customers to help them grow their businesses.

Small Business Loans for Veterans

So many veterans choose to run small businesses to help them meet their daily needs. If you are one of them, you should not struggle with working capital because we have perfect solutions for you.

Small Business Loans Rates

Charging high rates for small businesses can be quite suicidal. These brands are at the stages of development and hence need more money for business expansion. We try to reduce this burden by charging affordable rates to our small business loan customers.

Small Business Loans

Most of the big brands that you see now are beneficiaries of small business loans. The most important thing is to make sure that you use these funds in the right way. Our company has a long list of successful entrepreneurs who started with us as small businesses.

Small Business Loans for Woman

Women remain to be some of the most successful entrepreneurs in the United States. These people come up with very brilliant ideas that shake the whole world. Our company always looks for such people so that it can support them through small business loans.

How to Get Small Business Loans

To get a small business loans, all you need is a license to proof the existence of your business. We may also want to look at your financial records to help us determine the affordable installment.

Small Business Loans Near Me

Our company offers the best small business solutions in the region as we can easily visit your business and give you advice. It becomes much easier for the bank to trust you with more money because the loan officers know you in person.

Rates for Small Business Loans

The interest rates for small business loans tends to vary from those that we charge corporate brands. We will not expect so much from you in terms of interest because we want to see you grow. Once your business is big, you will be able to take larger loan amounts and give us more profits.

Small Business Loans for Minorities

Minority groups find it very hard to secure loans in America. However, this is not the case with us because we have special products that are meant to support this category of customers. Therefore, USA Funding Pros is the best place to go for small business loans for minorities.

How Do Small Business Loans Work?

Small businesses loans are specially designed to support the efforts of small-scale enterprises. After providing proof of business and your cash flows, the company will determine the amount that can help your business to move to the next level.

Small Business Loans New Business

Are you planning to start a nee small business? Lack of funds should not be a reason to hinder you from achieving your ambitions. Even though most financial institutions take these to be high risk ventures, we will walk with you until you grow into a big business.

Small Business Loans Online

Nowadays, you can get small business loans online as it does not require a lot od documentation. All you need to do is provide your personal and business details and then upload all the required documents. We will review your application and sanction it online.

Small Business Loans for Disabled Veterans

Disabled veterans need a special treatment when applying for small business loans. If you are one of them, you will not pay high interest rates on loans when you secure one from us. All you need to do is proof to us that you are a true veteran.

Qualifications for Small Business Loans

It is not hard to qualify for a small business loan as long as you are running a genuine business. Once we understand the operations of your business, we will give you sufficient funds to fund your operations.

Small Business Loans Unsecured

Small businesses can also get unsecured loans from our institution. Our firm is among the few institutions that trust small enterprises with unsecured loans.

Small Business Loans Amount

The amount of loans for any small business exclusively depends on its financial performance. Both overfunding and underfunding are not healthy for any brand regardless of the size. We carry out a thorough business assessment to determine the financial needs of your small business before approving the most appropriate amount.

Unsecured Loans

If you are going for an unsecured loan, you will not require a collateral to back up the loan. The lender looks at your current cash flows like the to determine the affordable installment and loan amount. Our terms are customer-friendly especially for those people who come to us for personal loans.

Unsecured Loans Personal

You can take unsecured personal loans for a broad range of reasons including home improvement, medical emergency, asses acquisition, business expansion, and many more. All you need is to convince the lender that you can afford the installment.

Where to Get Small Business Loans

So many entrepreneurs have great business ideas but they don’t know where to get small business loans. If you are one of them, your search has come to and end. We are a reliable brand for anyone who is looking for a loan for his or her small business.

Small Business Loans Quick

When you apply for a small business loan, it is good to make sure that you get the amount at the right time. You may end up missing on great opportunities because of delays. We are keen to this fact and hence disburse the loan amount within the shortest time possible.

Small Business Loans Companies

Several companies give loans to small businesses but we are the best for several reasons. Apart from giving your funds, our officers will also advice you on how to succeed in business. Our terns are flexible to help us meet your capital needs with the highest level of precision.

Unsecured Loans vs Secured

Secured loans need a collateral to back them up while unsecured ones don’t. If you qualify for an unsecured loan that is lower than your needs, you can increase the limit by providing a collateral. Most lenders charge less interest for secured loans because they carry a lower amount of risk.

Unsecured Loans for Business

Gone are the days when unsecured loans were specifically set aside for the salaried members of the society. We now give unsecured loans for businesses which makes the whole process quite simple.

Unsecured Loans Online

Nowadays, it is very easy to get unsecured loans online. The process is much simple because there is no need for security perfection. The loan is sanctioned and approved within a very short period. In some cases, it can even take one day to disburse the loan.

Unsecured Loans Debt Consolidation

Having so many debts can make your life to be so stressful. To help our clients, we give them unsecured loans that are easier to manage as a way of consolidating the debts.

Unsecured Loans to Consolidate Debt

You could be having so many small debts including credit card bills that have very high interest rates. When it such a state, it can become hard to track all your repayment. Besides, these debts will have adverse effects on your credit score. The best we can do to help you is giving you a cheaper unsecured loan to consolidate all these debts.

Unsecured Loans Rates

If you are looking for the best rates on unsecured loans, all you need to do is contact one of our loan officers. We have very amazing rates that you will not find in any other place in the region. It explains why we have a large customer base for personal loans that is ever growing.

Rates for Unsecured Loans

Let know one cheat you that unsecured loans are riskier and hence deserve to be expensive. Such an argument simply tells you that the officer did not do his KYC well. Come to us if you are looking for the most affordable rates on unsecured loans.

Unsecured Loans Near Me

When looking for unsecured loans near me, you need to understand that we are the best. The team takes the shortest time possible to process these loans. Besides, we have the most affordable unsecured loans in the entire region.

Unsecured Loans Interest Rates

In most cases, the interest rates for unsecured loans tend to be higher than the secured ones. According to most lenders, unsecured loans carry a higher level of risk. However, this is not the case with us. You will still get very good interest rates for our unsecured loans.

Unsecured Loans Low Interest

The best unsecured loans should come with lower interest rates. Even though some people think that this is not possible, you can surely get these products from our brand.

Unsecured Loans Companies

When looking for companies that offer unsecured loans in the United States, it is good to understand that we rank top on the list. You don’t need any form of collateral to access our unsecured loans. The most important thing for you is to display your ability to repay the loan.

Creative Financing

In most cases, creative loans help small business owners to acquire real estate, household, or business assets. Therefore, you no longer need to have large cash flows to be able to qualify for such loans. You can check with our company and we will come up with a flexible repayment plan that is specifically designed to meet your needs.

Unsecured Loans for Veterans

If you are a veteran, you can apply for unsecured loans from our company. We have special products for this group of people that come with so many benefits.

Unsecured Loans Types

There are different types of unsecured loans in the United States but it all depends with where your income comes from. It can either be business, salary, or any other. USA Funding Pros have great products regardless of the type of unsecured loan that you want.

Unsecured Loans Best Rates

Lenders have different rates for the unsecured loans that they offer to their customers in the United States. If you compare the various options, you will discover that we offer the best rates in the region. Take advantage of this opportunity by taking an unsecured loan from our company.

Creative Financing Options

There are so many creative financing options in the market. You can use them for funding business expansion, property acquisition, real estate, and many more. All these options are meant to give you the best experience as a customer. One of the primary responsibilities of our company is to make sure that you are getting the best creative financing options in the market.

What is Creative Financing

Creative financing is a non-traditional mode of financing where the lender agrees with the borrower on the best payment schedule that fits his lifestyle. It is an excellent funding alternative because the borrower does not struggle in meeting his obligation. Besides, it makes the borrower to qualify for huge loan amounts that he would not under the traditional lending mechanisms.

Creative Business Financing

You can also get creative business financing from our company. Once we understand the seasonality of your business, we will be able to come up with a prepayment schedule that fits into it perfectly.

Creative Financing Ideas

The ideas used in creative financing varies depending on the type of loan product and cash flows of the borrower. What will work for one person is very different from what works for another person.

Creative Financing Strategies

Lenders use different strategies in creative financing. Each strategy can be very unique depending in the prevailing situation. The most important thing is to give the borrower a product that will perfectly fit into his lifestyle.

Creative Financing Solutions

Several banks in the United States are known to offer creative financing solutions to the residents. However, USA Funding Pros come out to be the best because of the way we design our loan products.

Real Estate Investor Loan

It is very hard to use your savings to invest in real estate because of the magnitude of these associated amounts. Real estate investor lending come in handy to fund such products. You will use what you have as contribution to the project and the bank funds the remaining amount.

Real Estate Investor Financing

Currently, we offer the best real estate financing options in the market. If you have a dream of owning a real estate, we can help you to actualize it. We have flexible repayment plans that virtually anyone in the Unites States can afford.

New Venture Funding

Are you in the process of starting a new business? If yes, you will discover that most lenders shy away from funding new businesses. However, once we get to understand your business idea, we will give you the funds to get you rolling.

Secured Loans

When dealing with secured loans, the borrower has to provide the collateral to cover the loan. In case of failure to service the loan, the lender will sell the asses and get his money back. However, you should portray the ability to repay the loan because it is you to pay back the loan and not the asset. It is not the joy of any lender to recover the asset and use it in servicing the loan.

Secured Loans Online

Nowadays, you can get secured loans online hence making the whole application process quite easy. You need to provide your details and submit all the required documents. Our loan officers will verify all the information and documents that you provide. If there is any problem, we will get back to you for clarification. However, if everything is okay, the company will disburse the approved loan amount to your account.

Secured Loans for Bad Credit

The good thing about our secured loans is the fact that you can access them even with a bad credit history. The fact that you are willing to provide a collateral is reason enough to inform us that you have a commitment to repaying your loan. Therefore, we will not hesitate to award you the loan depending on your current income.

Secured Loans with Bad Credit

The fact that you have a bad credit history does not imply that you can’t repay a loan. We are willing to give you a secured loan and you can use this chance to improve your credit score.

Secured Loans for Business

Nowadays, even businesses can get secured loans by using part of their assets. We give our customers bigger business loans at better rates when they choose to secure them.

Secured Loans vs Unsecured Loan

It is always good to secure your loans if you want better terms. Even though you will meet a small cost for security perfection, you will save so much in terms of lower interest. Any genuine borrower will not have a problem securing the loan because he does not have an ill motive. At the end of the day, the borrower benefits the most from secured loans. However, if you don’t have an asset, feel free to come for our unsecured loans.

Secured Loans Rates

The rates of secured loans are always lower than those of unsecured loans. The reason is that these loans are less risky given that you are providing a collateral to cover for the loan.

How Does Secured Loans Work?

When going for a secured loan, you have to give the lender a guarantee that if you fail to meet your obligation, he will repossess the asset to cover the outstanding balance. However, it is you to pay the loan and not the asset and hence you need to display the ability to pay. The asset only acts as a fall back just in case you are unable to service your loan.

Secured Loan Debt Consolidation

The best thing you can do to consolidate your debts is by taking a secured loan. It will make it very easy for you to manage your debts. There is no need to carry so many debts yet there are cheaper options of consolidating your debts.

Secured Loan Collateral

Lenders accept collaterals from borrowers as a way of securing the loan. To make everything legal, the lender has to undertake the asset through the perfection process. Therefore, it becomes legally acceptable that if you default you loan, the lender will sell the asset and clear the loan balance.

Secured Loans Type

If you go through our loan book, you will discover that we have so many types of secured loans. It all depends with your ability to repay and the purpose of the loan.

Startup Business Loan Bad Credit

We can give you a loan to start a new business even if you have a bad credit score. No one should condemn you because several reasons can lead to bad credit scores. In fact, you can increase the amount and get better interest rates by securing your loan.

Startup Business Funding

If you are starting a business, you should not allow the lack of funds to stop you from achieving your goals. We have special loan products for startups that will allow you to take your business to the next level within no time.

Business Funding for Startup

Business funding for startups can be so challenging for most lenders. You rely on speculation to estimate the cash flows. However, our team has the right skills and experience to provide these estimates with a high level of accuracy. Most of the startups we have been funding have ended up into very successful businesses.

Startup Business Loan Rates

Some lenders charge higher interest rates to startups because they feel they are risky businesses. However, we do understand that you need money to fund your operations and expand your business. As a result, we strive to give you the most competitive rates especially if you are starting inn business.

How to Get Startup Business Funding

Most lenders in the United States shy away from giving out loans to startups. However, we value people who come up with new business ideas and will walk with them until they succeed. The only thing we need to do is check whether your start up idea is viable and we will give you the funds that you need.

SBA Loans

The demand for SBA loans in the United States is on the rise. These are customer-friendly products that focus on helping small business owners achieve more. It gives you the ability to qualify for loans that you would not get if you did not have the guarantee from SBA.

SBA Loans Requirements

The requirements of SBA loans are normally set by the agency. Both the lender and the borrower have to meet these requirements to be able to participate in this program. The good thing about these requirements is that they take good care of the borrower’s needs.

SBA Loans Rates

The primary goal is SBA is to help small business operators to access cheaper loans. The Small Business Administration guarantees these loans so that lenders can give them out at rates that are cheaper than the traditional products.

SBA Loans 504

One of the financial products that most people in the United States consume is the SBA loans 504. You will love this loan because of the low interest rate. It is a clear indication that SBA holds the interests of the borrower at the center of their operations.

SBA Loans Disaster

The Small Business Administration also guarantees loans for those people who are hit with a disaster that affects them economically. It is the desire of the agency that such calamities don’t take you down. You can take a loan that will help you get to your normal life within the shortest time possible. These are cheap loans that virtually anyone can afford.

SBA Loans for Veterans

If you are a veteran, you can benefit from the special loan packages that SBA has designed for you. Veterans get large loan amounts from the preferred lender within a short period. Besides, there are so many benefits that veterans stand to get from these loans including reduced interest rates.

SBA Loans for Woman

Women are among the key beneficiaries of SBA loans in the United States. The agency is very keen when it comes to the issue of women empowerment. You can get some of these great deals by taking SBA loans from us. We have some of the best products that will help you as a woman.

SBA Loans Business

One of the best ways to fund your business is through SBA loans. These loans help you to get larger amounts of working capital loans at better rates. You can get these loans by visiting USA Funding Pros. We are among the top lenders who partner with SBA to serve their target audience.

SBA Loans Interest Rate

The loan interest rates for SBA loans are normally lower than the other traditional loans. The lender has to agree with the rates that SBA provides to be able to disburse these loans. The Small Business Administration works towards giving borrowers the best rates.

Terms for SBA Loans

The terms of SBA loans are normally set by the Small Business Administration. The agency helps in setting the loan amounts and interest rates. If the lender violates these terms, the agency will not guarantee the loan. Therefore, you have to understand the terms of the agency and lender before applying for this loan.

SBA Loans Real Estate

You can use SBA loans to invest in real estate and move to the next level of life. The primary role of Small Business Administration is to empower traders. Most people find it hard to acquire real estate especially if they don’t have a stable income. However, with SBA loans for real estate, you can make your dream to come true.

SBA Loans Types

There are different types of SBA loans that you can apply from our company. However, the only loans that we give under this category are as per the stipulations of the Small Business Administration. You can use the money for asset acquisition, business expansion, exports, disaster, and many more.

SBA Loans for Small Business

SBA loans are of great benefit to small business owners. Your capacity may not allow you to own certain assets like property. However, SBA guarantees these small traders and you will be able to get a bigger loan amount at very competitive rates. It is a good way to achieve so much in life especially if you did not have the capacity.

SBA Loans Programs

The way in which SBA programs work is not hard to understand. One thing you need to understand is that SBA does not give borrowers loan. It partners with third party lenders such as banks to fund small business owners. The only thing that the agency does is to guarantee these loans.

SBA Loans Application

You need to meet certain requirements before submitting an SBA loan application. The lender will give you this loan subject to the standards that SBA has laid out. The good news is that it is not hard for any American citizen who is in business to qualify for this loan.

MCA Loans

One of the best inventions in the finance industry is the MCA loan. All you need is to have a long list of customers who make payment through their credit or debit cards. MCA loan limits depend on the number and volume of transactions. The cash that you receive from these payments is what you use to clear the loan.

MCA Business Loans

The demand for merchant business loans in the Unites States has been increasing each passing day. To increase your limit, all you need to do is encourage more customers to make card payments. The more amounts you get from card payments, the higher the MCA business loan limit you will have.

Merchant Cash Advance

You can now get merchant cash advance from our company. We value those retailers who accept credit and debit cards as a way of making payments. You will be able to secure some funds for business expansion through these payments.

Merchant Cash Advance Companies

Merchant cash advance companies give businesses loans against the amount they anticipate to receive from credit cards and debit cards. It has now become a top loan assessment technique in the United States.

Merchant Cash Advance Loan

With the popular use of credit and debit cards, the demand for merchant cash advance has also been on the rise. It is because of this reason that we decided to offer these loan products to our customers. The number of our merchant cash advance loan customers continues to grow each passing day.

What is Merchant Cash Advance

If you accept card payment in your business, you can get a statement of what customers pay through their debit and credit cards. Once the lender knows that trend of these payments, he can give you a loan against them. It is expected that you will use these receipts to clear the loan that you get. This is what we refer to as merchant cash advance.

Merchant Cash Advance Bad Credit

Merchant cash advance has become a popular way for businesses to get loans. Once we analyze the amount of money that you get from these channels, we will be able to give you a loan against these cash flows.

Shark Loans

Even though shark loans are expensive, they come in handy when you are in dire need. It will take you a few minutes and you will be having the loan money in your account.

Shark Loans Online

The primary role of shark loans is to help you when you are facing an urgent need. It will be meaningless for such loans to come with a high volume of paperwork. Allowing our customers to apply for these loans online increases the level of efficiency. You will be able to get this loan to your account within no time. The application process is simple and hence there are no delays.

Shark Loans Bad Credit

Shark loans come in handy especially when you are facing an emergency. You will be able to receive the loan amount within a few minutes. It is because of this that most of the people in the region prefer to come to us for shark loans. You will be able to get these loans even if you have a bad credit history.

Funding for Companies

One of the main problems that companies in the United States face is the element of liquidity. It will be hard to serve your customers if you don’t have sufficient funds. We come in handy to help you get the funds that you need most when running a company.

Funding Companies

Our company is the number one choice when it comes to funding companies. We have enough funds to increase the liquidity of your operations regardless of your needs. The good thing is that you will get our company loans at very affordable rates in the market.

Funding Companies for Startups

If you are planning to startup a company, you are welcome to come to us for working capital loan. So many startup companies are struggling because of the lack of funds. USA funding Pros will help you to overcome this challenge by giving you the funds that you need most.

Funding for Small Companies

We offer the best loan products for small companies in the United States. Our rates are relatively cheap in comparison to what the other service providers provide. The primary goal of our company is to see your small company grow into a big corporation. We have so many big brands in the region that we have helped to grow from small companies to big multinationals. Feel free to come us at any time when you are looking for funds for your small company.

Business Lines of Credit

With the business lines of credit, you will get access to funds from anywhere and at any time. It is one of the most reliable sources of funds especially when dealing with an urgent need of money. Once we score your account, we will be able to give you a limit. You can access the funds and after paying, these funds become accessible to you with immediate effect. You will never struggle because of lack of working capital if you take our lines of credit.

Lines of Credit for Business

Lines of credit for business work like any other credit bank that you get from financial institutions. We don’t have any hidden costs for this type of loan. Besides, our interest rates are affordable and you will only be charged for what you borrow.

Lines of Credit Loans

The number of people who request for lines of credit loans in the United States has been on the rise. This funding option comes with a high level of flexibility that most people are looking for. Once you have a limit, you can get the funds at any time as the need arises.

Lines of Credit Personal

Our company gives the best personal lines of credit to our customers. We have been offering these products to our customers with a high level of precision. The funds will help you to meet any personal needs that come your way.

Lines of Credit for Small Business

If you have a small business, you can come to USA Funding pros for lines of credit. The products are specially designed to meet this category of borrowers. The limit we give you will help you to meet any emerging business needs.

Lines of Credit Online

It is possible to get lines of credit online with us. Automating the process makes everything simple for our customers. You can submit your application through our website and we process everything over the internet. The most important thing is to make sure that you give us accurate details about your business.

How do Lines of Credit Work?

Understanding how lines of credit work is very easy. They are similar to credit cards only that the products are designed for small businesses. You will get a loan limit and you cannot exceed it while borrowing.

Equity Lines of Credit Rates

Equity lines of credit remain to be one of the fastest ways of getting business loans. We are the top brand in the region for this kind of loan products. It takes a very short time and you will be having your loan with you.

Lines of Credit Rates

The rates of lines of credit are not as high as you could be thinking. The main differentiating factor is the kind of service provider that you choose to use. Our company has some of the most competitive rates in the region when it comes to lines of credit.

Interest Rates for Lines of Credit

There is a strong belief that lines of credit come with a higher interest rate. However, this is not always the case as long as you do your homework well. We have very competitive rates for anyone who wants to take lines of credit with us.

Lines of Credit vs Loan

Lines of credit provide a more flexible way of accessing business funds than the ordinary loans. Most people prefer to go for them because you can avail the funds any time that you wish. The only challenge is that you will pay rates that are slightly higher than when taking ordinary loans.

How to Get Lines of Credit

To get a credit line, you need to start by identifying the best lender in the region. We have different service providers in the region but their terms and conditions vary from one to another. Therefore, you have to assess what various brands offer before choosing one of them.

Business Lines of Credit Rates

Most people will tell you that the credit rates for business lines is high. However, this is not the case especially if you look at the flexibility that comes with the product. You can be sure of getting the best rates when you come for credit lines from us.

Apply for Lines of Credit

We are the best brand for anyone who wants to apply for lines of credit. The limit that we give you is a clear reflection of your potential. If your cash flow increases, there is no worry because we can always increase your limit.

Lines of Credit Loans for Bad Credit

If you have a stable flow of income, you will get lines of credit even if you have a bad credit history. The fact that you had debt problems does not mean that you will stay there forever. Our company will analyze your current cash flows and give you lines of credit that fall within the limit.

Lines of Credit for New Business

It can be quite tricky to understand the expected cashflows from a startup. As a result, most lending organizations find it hard to give loans to business startups. However, we have well trained and highly experienced experts who know how to asses the market. As a result, we will not find it hard to give you lines of credit even if you have a new business.

Lines of Credit for New Businesses

We are one of the few companies that give lines of credit to startups. Our company will look at your current and anticipated cash flows and use the details to give you a credit limit.

Lines of Credit on Investment Properties

If you own an investment property, we can give you lines of credit against the income that you get from your property. The assumption is that the income that comes from your property is what will be used to repay the loan.

Business Lines of Credit Interest Rates

The interest rates for lines of credit is slightly higher than the other loan products. The good thing about it is the high level of flexibility. You can avail these funds at any time as per your needs making it a reliable source of funds.

Lines of Credit Basics

We offer the best lines of credit services in the region. It explains why we have the largest customer base for lines of credit in the region. We are highly efficient in processing your request and will give you the best rates on the amount that you consume.

Best Personal Lines of Credit

Once we give you a business line, you will be able to access a loan with a very high level of flexibility. The good thing is that you can use the funds in any way that you wish. Most people find themselves using the amount on personal needs other than business-related.

How Lines of Credit Work

Lines of credit work in a similar way like credit cards. The lender will evaluate your cash flows and credit history and give you a limit. It is not hard to get an excellent credit limit as long as you qualify. Come to us and we will be able to give you a limit against which you can borrow.

How to Get Funding for a Business

It is good to go for funding if you want to grow your business faster. We have a broad range of products that are specially designed to meet a broad range of customer needs. The most important thing is to make sure that you are getting a product that will meet your needs perfectly.

How to Get Funding to Start a Business

To get funding for business, you will need to provide the lender with proof for business. The other important thing is to display the ability to service the loan. We will take a very short period of time to get the business loan for us.

How to Get Funding for Startup

To get funding for a startup, the most important thing is to make sure that you meet all the legal requirements. The key defining elements are business license and the ability to repay the loan. Once you meet the criteria, you will not find it hard to secure a loan because the funds are always ready to help you out.

Best Funding Options

There are so many funding options in the United States but the best one remains to be loans. As a result, we have so many brands that give out loans to the residents of the region. Our brand is the best if you want a loan product that will give you the best service.

Entrepreneur Funding

The loan products that are used to fund entrepreneurs cannot be compared to any line of business-like farming or any other. We have specially designed products that match the needs of your industry. There is nothing that is too hard for us when it comes to funding entrepreneurs.

Funding for Entrepreneur

Entrepreneurs need a lot of funding to be able to expand their businesses. We have amazing loan products to help you when you want to grow your business. There is nothing that is impossible when it comes to funding entrepreneurs in the region.

Social Entrepreneur Funding

Social entrepreneurs face so many challenges when trying to secure funds to run their business. However, this should no longer be a bother to you because we provide loans to such people with the best terms and conditions.

Business Capital Loans

We have great products for business capital loans in the United States. You will get very flexible repayments depending on the nature of your industry. Our interest rates are relatively cheaper in comparison to what the other lenders in the region offer.

Capital for Small Business

The main challenge that most small business go through is working capital. This should not continue to be a problem to you if you want to take your brand to the next level. Our company is top on the game when it comes to providing capita for small businesses.

Working Capital for Small Business

For a small business to succeed, you need sufficient supply of working capital. However, this is not that easy especially because you are still in the process of setting up your business. You cannot rely on the current profits to be able to expand your brand. The best solution is coming to us for a loan and we will be able to help you out.

Small Business Funding

A small business needs enough capital to grow. As the number of customers continue to increase, you will need more money to be able to serve them better. The availability of funds should not be something that will stop you from achieving your ambitions. Feel free to visit us and we will give you the loan that your small business needs most.

Small Business Funding for Startups

If you interview small businesses, you will discover that the main challenge that most of them go through is funding. Customers want an excellent experience right from the onset. Therefore, having sufficient capital is paramount and we will help you out by providing the funds that you need most to startup your business.

Small Business Funding Start-Up

To get funding for startup, it is advisable to come to us. We understand that your business is still establishing and hence will charge you very friendly interest rates. We also give you flexible installments so that you will not struggle as you continue establishing your business.

Small Business Funding Options

Some of the options that you have for small business funding include using your own savings, borrowing from your friends and relatives or getting a loan from a financial institution. Loans seem to be the most reliable way to go because the funds are always available for any person who qualifies.

How to Get Small Business Funding

It is very easy to get a small business loan as long as you meet the terms and conditions of the lender. Therefore, you should go through the terms and conditions that different financial institutions offer to be able to choose the best. You need to choose a brand that has the best interests of your business at heart.

Small Business Funding Companies

There are very few companies that offer loans to small businesses in the United States. However, you should not go for any of them before you have a clear understanding of their terms and conditions. We are your number one choice when it comes to small business funding companies. You will get any amount of loan that you qualify at very competitive rates.

Business Credit Line

The demand for business credit lines in the United States is on the rise. It is a more flexible way of getting money at ant time. If you get an urgent order, all you will need to do is withdraw the funds. You are free to pay off your loan even after one or two days.

Business Credit Builder

The primary responsibility of a business credit builder is to help you get a high credit score. Once you achieve this, you will not find it hard to get a loan from any financial institution. You can get the best solution for business credit builder from us.

How to Build Business Credit

It is not a hard thing to build business credit as long as you repay your loan in good time. Credit reference bureaus use your loan repayment history to score your account. Therefore, to build business credit, all you need to do is repay your loans in a timely manner.

Funding for Startup Business

It is not hard to get a loan for your startup business as long as you cone to us with your business plan. Our financial experts will assess your business idea and help you through funding. The most important thing is to make sure that your business idea is viable.

Funding for Entrepreneurship

Entrepreneurship is everything that a society needs to be able to move to the next level. The economy will become stagnant if lenders and not willing to fund entrepreneurs. Our company gives special attention to this category of people. As a result, we will be able to fund you regardless of the amount of loan that you need as long as your brand has the ability to service the amount.

Funding for Startup Nonprofits

Most nonprofits struggle especially during the initial days of operation. You may have a brilliant idea but funding becomes an obstacle. Some lenders are hesitant when it comes to giving funds to this sector. However, you should not worry if you need such support because we are here to help you out.

Funding for Startup Restaurants

When starting a restaurant, you have to get it right from the onset. The kind of food and service that you give to your customers will determine whether you will succeed in this business or not. Therefore, it is advisable to have the right amount of stock and equipment before you open the business. the main challenge is that working capital is a limited resource. However, there is no need to worry because you can get a loan to start a restaurant from our financial institution.

Funding for Social Entrepreneurs

Social entrepreneurs have a special place in the United States. What these people do is unique and you cannot underestimate their efforts. To help them out, it is good to design loan products that specially address their needs. The unfortunate thing is that very few lenders work towards helping social entrepreneurs to achieve their goals. However, there is no need to worry because you can come to us and we will give you the support that you need most.

Funding for Tech Startup

The whole world is going the technological way and you cannot stay behind and expect to succeed. Therefore, there is a great need for lenders to understand the importance of putting more funds into funding tech startups. This knowledge informs our decision to come up with special products to fund tech startups and you can benefit from them a great deal.

Funding for Female Entrepreneurs

One of the most enterprising categories of people in the United States is made up of the women. You cannot never underestimate the potential that the female gender carries. To help them out, we have products that are specially designed for the women. You will pay better interest rates to get these loans from us.

Funding for My Startup

If you are planning to start a new business, the issue of getting working capital should not bother you in any way. There are so many successful corporates in the region that begun as small businesses. Through our advice and business advice, you will be able to grow into a big brand within no time.

Restaurant Funding

The best place to go for restaurant funding in the Unite States is USA Funding Pros. We have been funding several restaurants in the region and all of them have good success stories. Feel free to come to us today for the best deals in restaurant funding. We have a long list of happy customers who run restaurants in the United States and you can be one of them.

Funding for Restaurant Startup

Most people who own restaurants accept to the fact that the hardest task lies in starting the business. as customers step in, they will make a decision to either come in or go forever. Therefore, you have to make sure that you are giving them the best service ever from the onset. However, this can never be the case unless you have sufficient funds. There is no need to struggle with the issue of funding when we are here to help you out.

Funding for Gyms

Most gyms that go for loan funding are well equipped and attract a long list of customers. We are the best people to give you such funding if you want to take your gym to the next level. We charge very affordable interests for out loans meaning that you will not find it hard to repay.

Financing a Yoga Studio

Yoga activities require specialized equipment to be effective. When looking for a training center, customers want to find a Yoga machine that will help them to achieve their training goals faster. Come to USA Funding Pros for funding of Yoga equipment. It will help your facility to gain a competitive advantage in the region within no time.

Funding for Fitness Programs

The only thing that will differentiate your fitness center from the competitors is the kind of program that you run. However, this is not possible unless you have the right equipment. The challenge is that most of these machines are very expensive. Therefore, it can take you ages before you can be able to save and purchase them. The best way forward is to come to us for a loan and you will be able to buy machines for your fitness program within no time.

BE OUR CLIENT

If you are looking for a loan for your business, feel free to come to USA Funding Pros. Our company has the capacity to give you loans regardless of the amount that you need. We serve both small and big companies with no segregation. Our rates and installment amounts are quite affordable. It explains why we have the largest customer base in the region.

Here at USA Funding Pros, we love educating you on the funding process, whether you are a startup or an established business. So below are two of our preferred funding partners that we highly recommend. Fundwise Capital and David Allen Capital have provided the top funding solutions for thousands of entrepreneurs nationwide. You can read about them by clicking either of the two buttons below

We have a broad range of loan products to meet a various customer need.

Therefore, you can trust our brand regardless of the type of loan that you need. Here is a brief description of some of the services that we offer to our esteemed clients in the region.

- Startup Funding

- Startup Funding for Business

- Startup Funding for Small Business

- Startup Funding Website

- Start-up Funding For Nonprofits

- Startup Funding Companies

- Startup Funding Options

- Startup Funding Sources

- Startup Funding Stages

- Startup Funding Online

- How Startups Get Funding

- Business Funding

- Business Funding For Startups

- Business Funding Solutions

- Business Funding With Bad Credit

- Business Funding Fast

- Small Business Funding

- Business Funding Partners

- Business Funding For Veterans

- Business Funding Group

- Startup Funding Capital

- Small Business Loans

- Small Business Loans For Woman

- How to Get Small Business Loans

- Small Business Loans for Startup

- Small Business Loans for Veterans

- Small Business Loans Rates

- Small Business Loans Near Me

- Rates for Small Business Loans

- Small Business Loans for Minorities

- How Do Small Business Loans Work

- Small Business Loans New Business

- Small Business Loans Online

- Small Business Loans for Disabled Veterans

- Qualifications for Small Business Loans

- Small Business Loans Unsecured

- Where to Get Small Business Loans

- Small Business Loans Quick

- Small Business Loans Companies

- Small Business Loans Amount

- Unsecured Loans

- Unsecured Loans Personal

- Unsecured Loans vs Secured

- Unsecured Loans for Business

- Unsecured Loans Online

- Unsecured Loans Debt Consolidation

- Unsecured Loans to Consolidate Debt

- Unsecured Loans Rates

- Rates for Unsecured Loans

- Unsecured Loans Near Me

- Unsecured Loans Interest Rates

- Unsecured Loans for Veterans

- Unsecured Loans Types

- Unsecured Loans Best Rates

- Unsecured Loans Low Interest

- Unsecured Loans Companies

- Creative Financing

- Creative Financing Options

- What is Creative Financing

- Creative Business Financing

- Creative Financing Ideas

- Creative Financing Strategies

- Creative Financing Solutions

- Real Estate Investor Loan

- Real Estate Investor Financing

- New Venture Funding

- Secured Loans

- Secured online loans

- Secured Loans for Bad Credit

- Secured Loans with Bad Credit

- Secured Loans for Business

- Secured Loans vs. Unsecured Loan

- Secured Loans Rates

- How Does Secured Loans Work

- Secured Loan Debt Consolidation

- Secured Loan Collateral

- Secured Loans Types

- Start-up Business Loan (Bad Credit Rating)

- Start-up Business Funding

- Business Funding for Startup

- Startup Business Loan Rates

- How to apply for Startup Business Funding

- SBA Loans

- SBA Loans Requirements

- SBA Loans Rates

- SBA Loans (504)

- SBA Loans Disaster

- SBA Loans for Veterans

- SBA Loans for Woman

- SBA Loans Business

- SBA Loans Interest Rate

- Terms for SBA Loans

- SBA Loans Real Estate

- SBA Loans Types

- SBA Loans for Small Business

- SBA Loans Programs

- SBA Loans Applications

- MCA Loans

- MCA Business Loans

- Merchant Cash Advance

- Merchant Cash Advance Companies

- Merchant Cash Advance Loan

- What is Merchant Cash Advance

- Merchant Cash Advance Bad Credit

- Shark Loans

- Shark Loans Online

- Shark Loans and Bad Credit

- Funding for Companies

- Funding Companies

- Funding Companies for Startups

- Funding for Small Companies

- Business Lines of Credit

- Lines of Credit for Business

- Lines of Credit Loans

- Lines Credit Personal

- Lines of Credit for Small Business

- Lines of Credit Online

- How do Lines of Credit Work

- Equity Lines of Credit Rates

- Lines of Credit Rates

- Interest Rates for Lines Credit

- Lines of Credit vs. Loan

- How to Get Lines of Credit

- Business Lines of Credit Rates

- Apply for Lines of Credit

- Lines of Credit Loans for Bad Credit

- Lines of Credit for New Business

- Lines of Credit for New Businesses

- Lines of Credit on Investment Properties

- Business Lines of Credit Interest Rates

- Lines of Credit Basics

- Best Personal Lines of Credit

- How Line of Credit Work

- How to Get the Funding for a Business

- How to Get Funding to Start a Business

- How to Get Funding for Startup

- Best Funding Options

- Entrepreneur Funding

- Funding for Entrepreneur

- Social Entrepreneur Funding

- Business Capital Loan

- Capital for Small Business

- Working Capital for Small Business

- Small Business Funding

- Small Business Funding for Startups

- Small Business Funding StartUp

- Small Business Funding Options

- How to Get Small Business Funding

- Small Business Funding Companies

- Business Credit Line

- Business Credit Builder

- How to Build Business Credit

- Funding for Startup Business

- Funding for Entrepreneurship

- Funding for Startup Nonprofits

- Funding for Startup Restaurants

- Funding for Social Entrepreneurs

- Funding for Tech Startup

- Funding for Female Entrepreneurs

- Funding for My Startup

- Restaurant Funding

- Funding for Restaurant Startup

- Funding for Gyms

- Financing a Yoga Studio

- Funding for Fitness Programs

- David Allen Capital

- Fundwise Capital